closed end funds leverage risk

Most closed funds use leverage borrowing to invest more than assets to boost their returns and distributions. The actual closed-end fund structure is the ability to offer preferred.

Investing In Closed End Funds Nuveen

But CEFs can entail risk.

. What is Leverage in a Closed-End Fund. If the fund borrows another 1 million at a cost of 3 percent the earnings jump to 180000 minus 30000 in debt interest payments 1 million x 3 percent for net earnings of 150000 or a 75. Structural leverage the most common type of leverage used by closed-end funds affects the closed-end funds capital structure by increasing the funds portfolio assets.

The first closed-end funds were introduced in the US. Most closed-end funds use leverage in an effort to enhance the funds return income or both. Financial leverage is created whenever closed-end fund common shareholders have investment reward and risk exposure equivalent to more than 100 of their investment capital.

Increasing leverage in a closed-end bond fund increases both its expected return and its standard deviation but does not increase its Sharpe ratio. The authors demonstrate that the debt of. Understanding Leverage in Closed-End Funds LikE ArChimEdEs LEvEr leverage in an investment offers the opportunity to effectively magniyf.

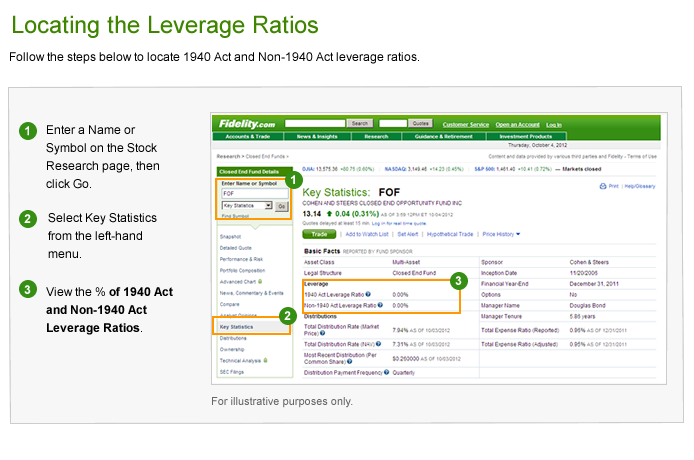

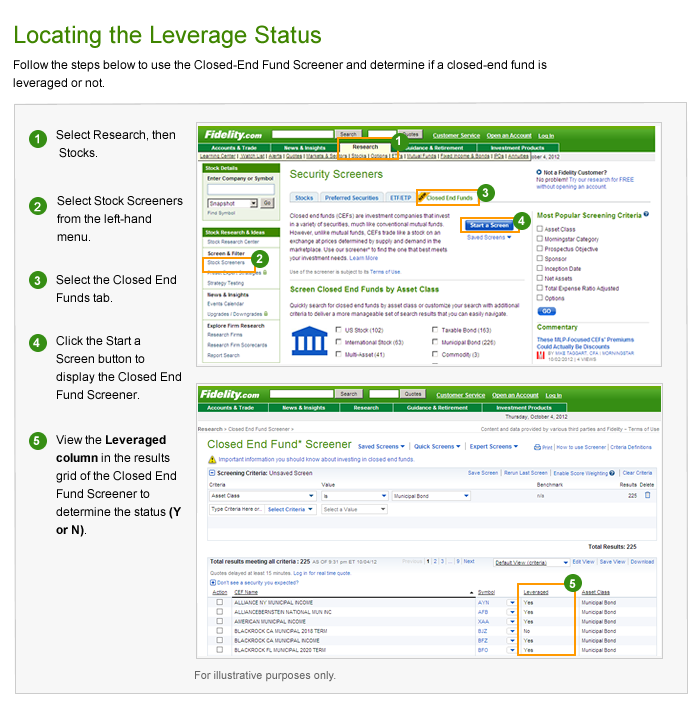

In fact the Nuveen fund has a 38 leverage ratio which means its. Suppose a CEF has 33 leverage. See locating the leverage status using the closed-end fund screener for more information.

Financial leverage is created whenever closed-end fund common shareholders have investment reward and risk exposure equivalent to more than 100 of their investment capital. Closed-end funds can be one solution. Closed-end funds will generally keep structural leverage between 20 to 40 of the value of its assets.

Its assets are actively managed by the funds. Theres portfolio leverage like derivatives and TOBs and things of that nature then theres structural leverage. Of leverage and leveraged closed-end funds.

Leverage the ability of closed-end funds to issue debt or raise money through the sale of preferred shares is a unique feature of closed-end funds. On the following pages we provide an overview of how leverage works strategies used to create leverage and their inherent costs as well as the potential benefits and risks that leverage entails. However that compares to average standard deviation on the NAVs of 547.

Even closed-end funds CEFs which some investors turn to for relative safety versus individual stocks given CEFs diverse portfolios can sport high leverage of between 30 and. Closed-end funds have the ability to use leverage which can lead to greater risk but also greater rewards. Leverage is created whenever a closed-end fund common shareholder has investment exposure both reward and risk equivalent to more than 100 of his or her investment capital.

Closed-end funds create leverage by borrowing at short-term rates then using that money to invest in strategies or instruments providing longer-term returns. The use of leverage is subject to risks. Closed-end funds are able to take out debt to invest even more money into their selections which can certainly lead to more volatility but also bigger distribution rates and.

5 from preferred shares 10 in net asset value 50. CEFs are exposed to much of the same risk as other exchange traded products including liquidity risk on the secondary market credit risk concentration risk and discount risk. Fund managers are able to.

Understanding leverage in closed-end funds. Leverage is a strategy that can be employed by closed-end funds CEFs in an effort to potentially increase income and enhance returns. This CEF has a leverage ratio of 50 computed as capital from preferred shares divided by net asset value.

In the S-Network Municipal Bond Closed-End Fund Index CEFMX 56 out of 58 constituents use leverage with an average leverage ratio of approximately 32 says Alerian. Opportunistic use of leverage in order to potentially capitalize at times on market dislocations. For every 1 you pay per share.

In other words the risk as measured by standard deviation would show that the average fund is. Leverage magnifies returns both positively and negatively. This leverage can lead to higher returns for investors but it also makes.

The potential to benefit from unique alpha opportunities in the closed-end fund market. In 1893 more than. A closed-end fund is a type of investment company whose shares are traded on a stock exchange or in the over-the-counter market.

Closed End Funds Calamos Investments

Understanding Leverage In Closed End Funds Nuveen

What Is A Closed End Fund And Should You Invest In One Nerdwallet

Closed End Fund Leverage Fidelity

Guide To Closed End Funds Money For The Rest Of Us

Understanding Leverage In Closed End Funds Nuveen

What Are Mutual Funds 365 Financial Analyst

A Guide To Investing In Closed End Funds Cefs Intelligent Income By Simply Safe Dividends

Guide To Closed End Funds Money For The Rest Of Us

Understanding Leverage In Closed End Funds Nuveen

A Guide To Investing In Closed End Funds Cefs Intelligent Income By Simply Safe Dividends

5 Reasons To Use Closed End Funds In Your Portfolio Blackrock

Understanding Leverage In Closed End Funds Nuveen

What Are Closed End Funds Fidelity

What Is The Difference Between Closed And Open Ended Funds Quora

Closed End Fund Leverage Fidelity

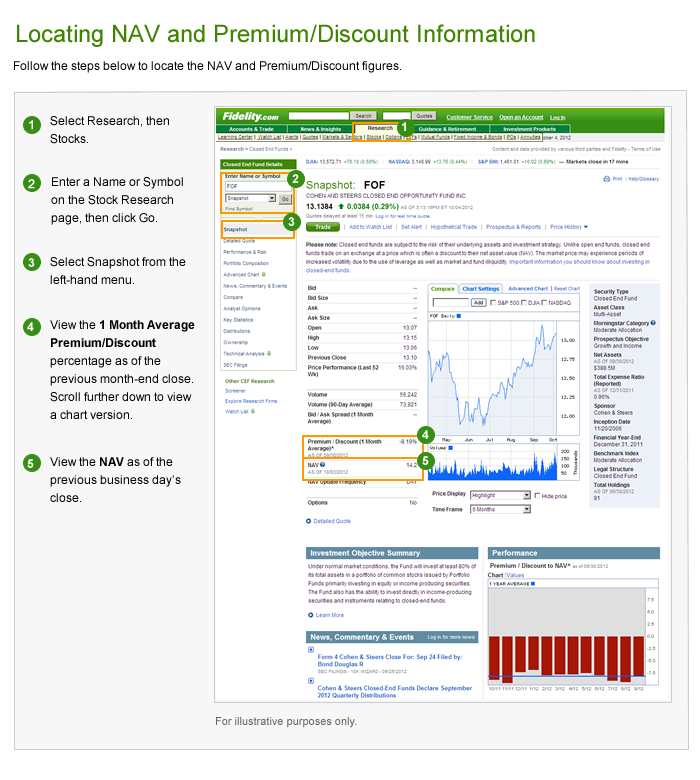

Closed End Fund Cef Discounts And Premiums Fidelity

5 Best High Yielding Closed End Funds To Buy

A Guide To Investing In Closed End Funds Cefs Intelligent Income By Simply Safe Dividends